Are you thinking about becoming a CPA? There are plenty of reasons to do so. The pay is good and it’s not your typical 9 to 5 job. But you should also be aware that there can be a few potential downsides. It will be up to you to make your choice after knowing all that you need to know before you can become a certified public accountant.

1. You Need to Pass the CPA Exam

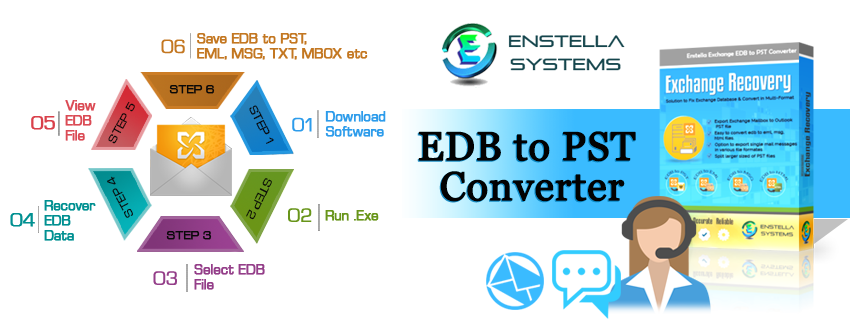

The first thing you will need to do before you can become a CPA passes the exam. To do this, you will need to know how to study for CPA exam. There are plenty of guides available on the web for you to check out. You can use them to get yourself up to speed on all of the basics. Doing so will give you valuable aid to ace the exam and begin your career.

2. You Don’t Need a CPA to Do Taxes

Of course, you should also be aware of the fact that you may not actually need to have a CPA license in order to do taxes. There are several other routes that you can take in order to earn the credentials needed to pursue a career. You can choose to become a Licensed Tax Consultant or IRS Enrolled Agent instead.

Doing so will enable you to get to the point of doing taxes directly. This will let you avoid having to go through any kind of training in accounting. If this latter course is too dull for you to engage in, it would be better to pursue one of these choices. It’s always good to be aware of all of your extra options.

3. A CPA Won’t Only Do Taxes

One of the most crucial things that you should be aware of is the fact that a CPA doesn’t only do taxes. There are quite a few other tasks that you can decide to take on if the mood or the chance hits. You can teach others how to do this job. You can audit other people’s performance to help grade their CPA skills.

You can appear in the capacity of a witness in civil claim court cases that involve the matter of accounting. You can also help people organize their businesses with a mind toward getting their financial affairs in order from the very start. As can be seen, there are plenty of choices that you can make in a career as a CPA.

4. A CPA Never Has to Work 9 to 5

One of the best things about becoming a CPA is that you will never have to work the standard 9 to 5 shift. There are plenty of other options that you can take in order to do this job. You can have your office all to yourself at any hour of the day you choose. You won’t even need an office if you prefer to work at home.

You can schedule your services to take care of the needs of people before they go to work. If you prefer, you can do your job later in the day so that you can reach people who are out taking care of various errands. If you choose to work from home, you can set your schedule to the hours that make the most sense.

5. January to April is Prime Tax Season

One thing that you will need to come to terms with is the fact that the 90 day period from January to April is prime tax season. During this time, you will have very little time to yourself. In fact, you will have very little time to do anything else but taxes. The work will be coming in hot, heavy, and nonstop.

6. There Will Always Be a Job For You

Despite the advancement of technology with self-filing software services like TurboTax, the need for accountants will never go away. Taxes whether they are personal or for businesses can be extremely complicated for those who are not CPAs. This is why the CPA certification is so important. CPAs’ expertise will always be needed to make sure not only that the numbers are accurate but also that filing is in compliance with the law. By deciding to become a CPA you can feel secure that there will always be a demand for your services whether you decide to join a firm or venture into a freelance practice.

Choose Your Career Path with Great Care

Being a CPA brings many rewards. There are a few downsides to consider as well. It will be up to you to make the choice that is right for your personal needs. If you are okay with working nonstop from January to April, you can budget the rest of the year to fit in with this hard work schedule. The payoff will be very well worth it.

Author Bio:

Lizzie Howard is a Colorado native who after graduating from the University of Colorado spends her time as a freelance writer. When Lizzie isn’t writing, she enjoys going on hikes, baking for her friends and family, and spending time with her beloved yellow lab, Sparky. If you want to know more about how to study for a cpa exam.