The retail sector has been undergoing phenomenal changes and new challenges are being faced by those who are involved in this industry. Since 2017, there have been numerous retail companies which have gone bankrupt and this trend has continued to date. Though this is not a healthy trend, this doesn’t mean that the retail industry is doomed forever. Do you have your own retail store, then check it to know how these stores to design a virtual shopping experience.

Inspite of numerous cases of bankruptcies, there are major retailers who have been able to survive and grow their businesses despite all challenges. Then, what are the exact challenges that retail businesses are facing today and how they can be avoided.

Overreliance on business accounting software

There are numerous accounting errors which are usually overlooked but can be easily tracked during a manual audit. But, small retail businesses often fail to catch them because of their overdependence on accounting software. Businesses irrespective of their size need to perform regular financial audits for tracking accounting errors in their spreadsheets, or for errors which their software has failed to detect. The sooner you realize that all of your errors will be detected by any accounting software, the easier will it be for you to check these errors. Therefore, a business should invest time in hiring professional accountants only.

Lack of awareness about your business’s well-being

As an entrepreneur, you need to have a clear perception of your company’s financial health, whether you handle your accounts on your own or hire business accounting services for the same. To have a clear perception of your financial process, you need to have a basic understanding of accounting and bookkeeping services. It will help you to determine the financial health of your organization. Unless you have a good understanding of numbers, you will fail to make wise business decisions. You need to have a clear perception of your cash, assets, and liabilities.

A major mistake that retail owners often make is that they feel that they are performing satisfactorily just because they have sufficient money in the bank. But, unless you don’t compare your accounts with liabilities, you might feel that there are no financial problems related to your business which is not the case.

Forgetting to save important financial records

There are many reasons why many businesses often fail to store important financial records safely. In case they lose their financial details, they can find appropriate answers to find an answer to their problems. It is essential to maintain financial records if your business is audited by the IRS. The IRS can audit your returns for a period of three years from the filing date. So, your business should have all the finance-related documents for at least that period. But, if the IRS suspects that you have underreported your gross income by 25% or more, they can add up to six years to challenge your return. As an established rule, your business should always maintain records related to your earnings as well as deductions for at least seven years for protecting your business during an audit.

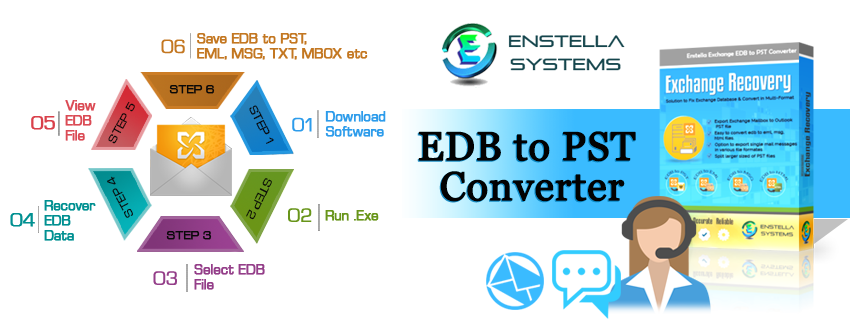

Lack of backup for financial record storage

Numerous businesses make this folly of storing their financial statements at one specific place only, whether it is a computer, filing cabinet, or an external hard drive. What they don’t take into consideration is the risk associated with data loss, accidental deletion, hardware errors which make it impossible for them to get financial records. It is important to decide how you can store the financial records of your business when you prepare to deal with data loss. Smart businesses store their data in more than one location by utilizing the off-site cloud backup provider. Cloud backup is the only way through which you can avert the problem of data loss. By opting for cloud storage, you can make sure that your accounting data is retrievable at all times, irrespective of your location with an internet connection so that you can restore your data to the same device or a new one in case your data is lost. Here is about how to back up the office 365 mailbox to Outlook PST.

To safeguard your data and check issues related to data loss for the better, look for an online bookkeeping services provider who offers continuously data backup, recording new and changed files as you create them. The company whom you hire should offer unlimited previous file versioning to help you revert any document you want to in an earlier state. This will be helpful if your business data and financial records get encrypted by a virus, or you feel that it is too late to amend a mistake which you have committed.

Ignoring the business’s financial health

Even if you are handling accounts flawlessly related to your business, it won’t be beneficial to your business if don’t pay attention to numbers. Successful business owners don’t quickly take any business decision. They analyze the financial standing of their business perfectly and use them to decide the exact steps they want to take. They also assign particular budgets to each project which they invest in and stick to it. Without taking such steps, it will be easy for your business to spend excessive money on a project which will be detrimental for your business.

Updating income and costs on an infrequently basis

When you don’t record the earnings and expenses related to your business, it is easy for errors to creep in. You can fail to take smaller transactions. Irrespective of the exact expense or income, you need to ensure record the numbers as quickly to check the unrecorded financial data. If you don’t, small errors will keep adding up. If it is left unchecked, your business can under-report profits or deductions-neither of which is a wise way for your taxes or your capability to make data-driven decisions for your business.

Having a clear idea of these accounting issues will enable you to avoid them before troubles crop up. You can enable your business to avoid the loss, misplacement, and deletion of financial records by ensuring that you have sufficient data backup. You will be able to keep accounts related issues at bay as a result.